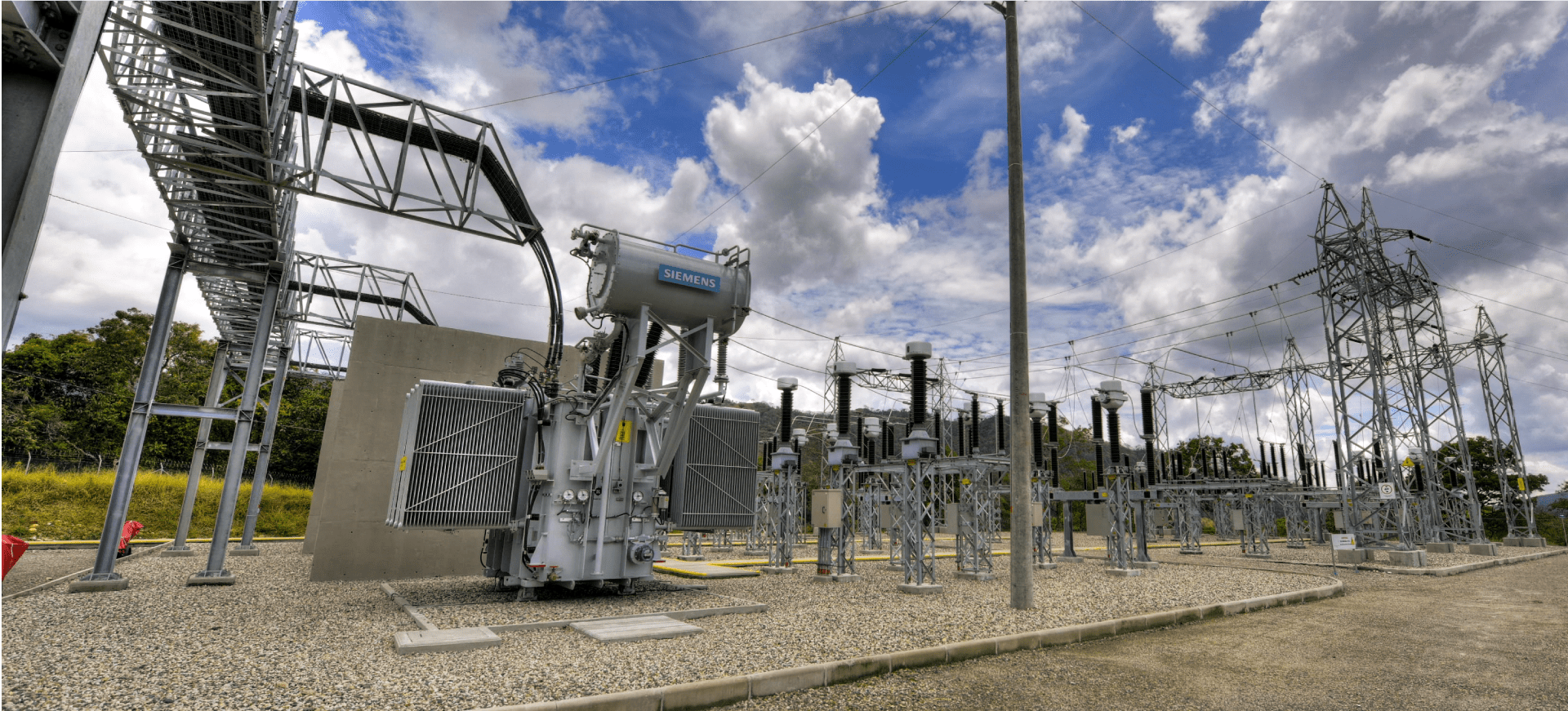

Course2 Energy invests in globally scalable platforms, targeting investments ranging

from $50 million to $200 million. We operate exclusively within politically stable, and

investment-friendly jurisdictions, focusing on scaling companies through partnerships

with seasoned global management teams.

We seek controlling stakes and, opportunistically, influential minority investments with

significant rights. We bring deep operational insight and leverage our industry-specific

expertise to create value.

We drive value through Engineering, Procurement, and Construction (EPC), operations

optimization and strategic value creation initiatives. At the core of our strategy is the

adoption of low-risk, OEM-backed technologies, which guarantee robust, sustainable

asset performance and effective risk mitigation, all structured towards facilitating a

well-defined strategic exit.

Deal Characteristics and Value Creation Process

Course2 is focused on active investments with downside risk

mitigation through contractual revenues and a risk management

framework. Tenets of our investment strategy include:

Invest in businesses with

stable and contracted

cash flow

Focus on operational and

strategic value creation

Drive value creation through

deep sector expertise

Minimize technological risks

by partnering with

industry-leading OEMs

Implement key governance

protections to safeguard our

investment and drive value

Establish a robust

risk-mitigation framework

for our investments